Even this Labour minister acknowledges that Britain is not great for under-50s

- Last update: 1 days ago

- 2 min read

- 293 Views

- WORLD

Josh Simons, a Labour minister, has openly acknowledged the severe challenges confronting younger Britons. He stated that balancing parenthood with saving for a home is nearly impossible, describing the nations birth rate as a major concern. Financial pressures mean that many in their 20s, 30s, and 40s face a tough reality, even for those with professional qualifications and stable jobs.

Simons, who is raising three young children himself, highlighted a widening gap in the economy: older generations generally feel financially secure, while those under 50, especially the ambitious, are struggling. He cited migration statistics showing a net loss of over 100,000 Britons aged 16 to 54 to overseas opportunities in a single year, with only the over-55s seeing net gains.

Recent budget policies have added to these pressures. Freezes on income tax thresholds and National Insurance contributions disproportionately impact younger workers, while student loan repayments further reduce disposable income. Families with children also face steep financial cliffs in benefits and subsidies, creating a disincentive for early family planning.

Simons pointed out that saving for the future is increasingly difficult. Limits on tax-advantaged savings accounts are lower for the under-65s, and changes to salary sacrifice schemes further reduce opportunities for tax-efficient retirement saving. Combined with soaring house prices and rent, these factors make financial stability elusive for younger generations.

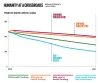

Comparisons of living standards reveal a stark generational divide. Since 2000, real disposable incomes for retired households have increased by over 50%, while non-retired households have seen growth of only 27.6%. Policies such as the state pension triple lock have further widened the gap, ensuring pensions rise faster than average earnings and remaining politically difficult to reverse.

The overall effect is a growing tax and benefits imbalance. Younger workers carry a rising tax burden while public spending heavily favors the elderly, whose numbers are increasing due to longer life expectancy and low birth rates. Migration has helped offset some pressure, but the trend remains concerning as ambitious young adults leave the UK, potentially exacerbating the financial strain on public services.

Although the recent budget introduced measures benefiting working-age families, such as removing the two-child limit in Universal Credit, the broader picture suggests persistent challenges. For those under 50, the combination of high costs, tax pressure, and limited financial support paints a difficult outlook for both savings and family life.

Author: Ethan Caldwell

Share

Government promises to put an end to children residing in B&Bs

1 days ago 3 min read WORLD

Reeves may have to cut school funding due to declining birth rate

1 days ago 3 min read BUSINESS

Bill Gates criticizes ‘major increase in child mortality’ as nearly 5 million kids will die before turning 5 this year

2 days ago 3 min read BUSINESS

Global health funding cuts lead to increase in child deaths, reversing decades of progress

2 days ago 3 min read WORLD

Reeves relaxes eligibility requirements for teenagers with ADHD

5 days ago 3 min read HEALTH